Understanding Employer Death in Service Benefits

Many employers offer a valuable benefit known as "Death in Service" or "Group Life Insurance" as part of their employee benefits package. This benefit provides financial protection to employees' families in the unfortunate event of their untimely death while employed by the company. In this article, we will delve into how employer Death in Service benefits work, its significance, and the benefits it provides to both employees and employers.

Interest-Only vs. Capital Repayment Mortgages: A Comprehensive Comparison

Choosing the right mortgage is a critical decision. Two of the most common mortgage types are interest-only mortgages and capital repayment mortgages. Each has its unique characteristics, advantages, and drawbacks. In this comprehensive comparison, we'll delve into the differences between these two mortgage types to help you make an informed choice.

The Biggest Financial Risk Isn’t Death — It’s Being Alive

Most people assume the greatest financial threat they face is dying too soon. It feels dramatic, final and easy to imagine as the ultimate disruption. But in reality, the biggest financial risk isn’t death at all. It’s living, living with a critical illness for instance, causing income shocks and lifestyle changes that quietly erode financial stability over time.

Understanding the UK Personal Savings Allowance and Strategies to Optimise It

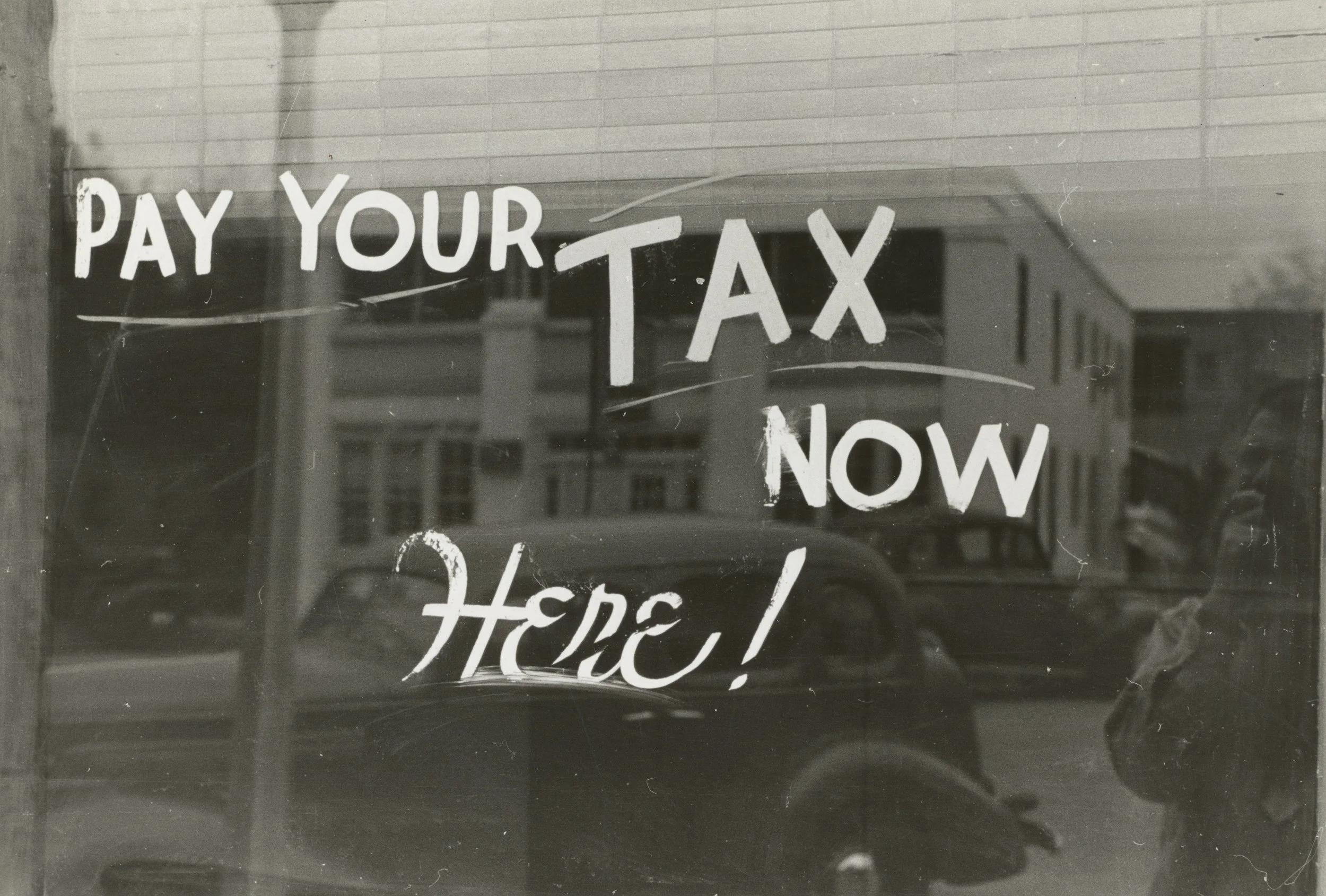

The Personal Savings Allowance (PSA) is a key component of the tax system introduced in April 2016. It offers taxpayers the opportunity to earn tax-free interest on their savings and investments, thereby reducing their tax liability. In this article, we will explore what the Personal Savings Allowance is, how it works, and discuss strategies to make the most of this valuable tax benefit.

Why Cash Isn’t Always King: Building Wealth for the Long Term

When it comes to managing money, many people instinctively believe that holding cash is the safest and smartest option. After all, cash feels secure. It’s tangible, accessible, and doesn’t fluctuate in value like investments do. But while cash plays an important role in financial planning, it’s not always the best choice for creating long-term wealth.

Let’s explore why cash isn’t always king, the importance of an emergency fund, and why investing could be the key to achieving your future goals.

The Power of Early Saving: The Benefits of Starting a Pension Young

Saving into a pension at an early age is a strategic financial decision that can profoundly impact your future financial security. The sooner you begin, the more time your investments have to grow, and the greater the benefits you can reap. In this article, we will explore the numerous advantages of initiating pension contributions early in your career.

Understanding Income Protection: Benefits and Peace of Mind

Life is filled with uncertainties, and while we can't predict the future, we can certainly prepare for it. One crucial way to do so is by having life insurance. Life cover provides financial protection and peace of mind to individuals and their families. In this article, we will explore five compelling reasons why you should consider having this financial protection in place.

5 Important Steps As Your Fixed-Rate Mortgage Approaches Expiry

If you are a homeowner with a fixed-rate mortgage, you may be approaching the end of your fixed-rate term. This marks a crucial juncture in your mortgage journey, as it opens up various opportunities and considerations. In this article, we'll explore five important things to do as you approach the expiry of your fixed-rate mortgage product.

What is a Deferred Payment Arrangement (DPA) and Why It Can Be a Valuable Option?

When planning for later life, one of the most pressing concerns for many families is how to fund long-term care. With care costs often running into thousands of pounds per month, it’s no surprise that people worry about whether they will need to sell their home to pay for care. This is where a Deferred Payment Arrangement (DPA) can offer a practical solution.

Demystifying ISAs: Your Guide to Tax-Efficient Saving

Individual Savings Accounts (ISAs) are versatile and tax-efficient savings and investment vehicles available to UK residents. Established in 1999, ISAs have become a popular choice for individuals looking to grow their money without worrying about taxes eating into their returns. In this article, we will delve into the world of ISAs, explaining what they are, how they work, and the various types available to UK residents.

Understanding Prenuptial and Postnuptial Agreements: Are They Worth It?

When planning a wedding, conversations about love, family, and the future dominate. Yet, one topic often overlooked is financial protection. Prenuptial and postnuptial agreements, commonly called prenups and post-nups are tools designed to safeguard wealth and clarify financial arrangements should the marriage end. While they may seem unromantic, they can be invaluable for couples who want certainty and fairness.

Understanding Immediate Needs Annuities: A Financial Lifeline for Long-Term Care

When planning for later life, one of the most pressing concerns for many families is how to fund long-term care. Whether it's residential care, nursing support, or assistance at home, the costs can be substantial and unpredictable. One financial product designed specifically to address this challenge is the Immediate Needs Annuity.

5 Compelling Reasons To Save Into a Pension

Saving into a UK pension is a wise financial decision that can have a profound impact on your future financial well-being. While there are various ways to save and invest, pensions offer unique advantages tailored to retirement planning. In this article, we will explore five compelling reasons why you should prioritise saving into a UK pension.

The New Rules of Retirement: Understanding the Lump Sum and Death Benefit Allowance (LSDBA)

In April 2024, the UK pension landscape underwent a significant change with the introduction of the Lump Sum Death Benefit Allowance (LSDBA). This new allowance is part of the broader reforms following the abolition of the Lifetime Allowance (LTA), and it plays a crucial role in how pension benefits are taxed when passed on after death.

Understanding Inheritance Tax: A Comprehensive Guide

Inheritance tax (IHT) is a financial topic that often creates confusion and concern among individuals and families in the United Kingdom. It is a tax levied on the value of an individual's estate (property, possessions, and money) when they pass away. In this comprehensive guide, we will explore what inheritance tax, how it works, who is affected, exemptions, and strategies to mitigate its impact.

The New Rules of Retirement: Understanding the Lump Sum Allowance

If you’ve been keeping an eye on your pension savings, you may have come across the term Lump Sum Allowance, especially since the UK government introduced changes to pension tax rules in April 2024. But what does it actually mean, and how does it affect your retirement planning?

5 Compelling Reasons Why You Should Have Life Cover

Life is filled with uncertainties, and while we can't predict the future, we can certainly prepare for it. One crucial way to do so is by having life insurance. Life cover provides financial protection and peace of mind to individuals and their families. In this article, we will explore five compelling reasons why you should consider having this financial protection in place.

Beyond Stocks and Shares: A Look at Alternative Investments

When most people think of investing, their minds go straight to stocks, bonds, or property. But for those looking to diversify their portfolios or inject a bit of passion into their financial planning, alternative investments offer a compelling route. From vintage watches to rare collectables, these tangible assets can be both financially rewarding and personally satisfying. However, they come with their own set of risks and tax considerations, and you still need to consider the UK's Capital Gains Tax (CGT) rules on chattels.

Navigating the Home Buying Process: A Comprehensive Guide

Buying a house is a significant milestone in many people's lives. However, the process can be intricate and overwhelming, especially for first-time buyers. In this comprehensive guide, we will walk you through the essential steps involved in purchasing a property, providing you with valuable insights and tips to make the process smoother and less stressful.

The Lifetime Allowance: A Brief History and Its Impact Today

Since its introduction in 2006, the Lifetime Allowance (LTA) has been a cornerstone of UK pension legislation, shaping how individuals save for retirement. Though it was abolished in April 2024, its legacy continues to influence financial planning decisions today. Understanding its evolution and implications is essential for anyone navigating pensions, especially those with significant retirement savings.